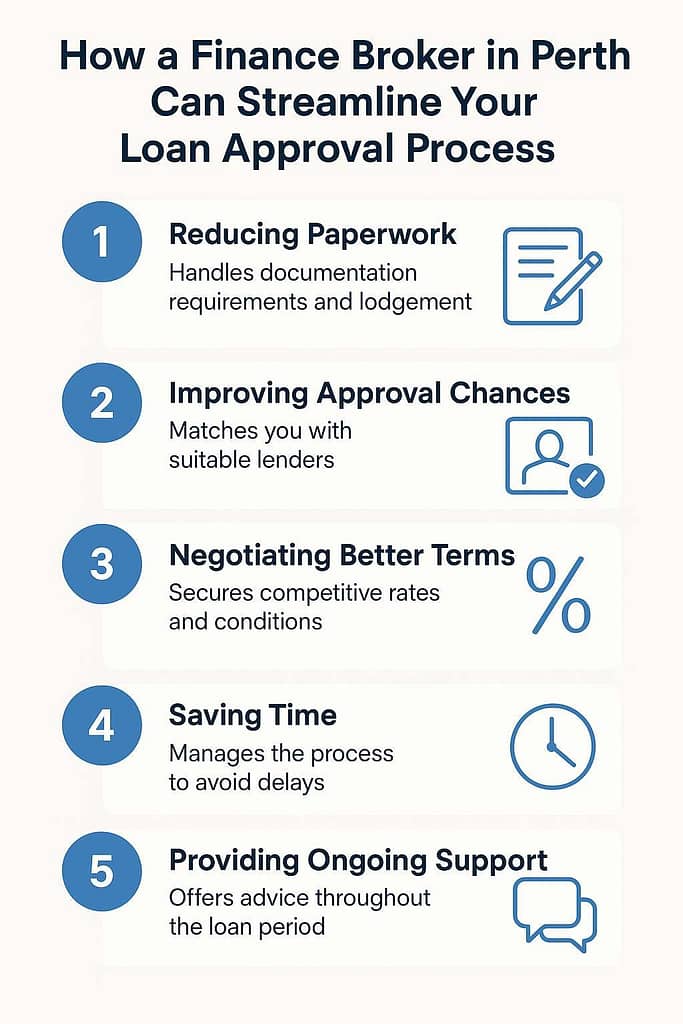

Applying for a loan can be one of the most time-intensive and stressful aspects of financial planning—especially without insider knowledge of lender policies, approval criteria, and documentation requirements. That’s where a finance broker in Perth becomes invaluable. Acting as an intermediary between borrowers and lenders, a finance broker doesn’t just submit applications—they streamline the entire process. This includes significantly reducing paperwork, boosting approval chances, and negotiating competitive terms from a broad network of lenders.

1. Reducing Paperwork and Administrative Burden

Loan applications typically require a substantial amount of documentation: identification, income verification, tax returns, credit history, asset declarations, and more. Each lender has different criteria and formats, which makes direct applications time-consuming and prone to error.

A finance broker simplifies this by:

- Collating and verifying all necessary documents upfront: Ensuring nothing is missing or incorrectly presented.

- Tailoring the paperwork per lender requirement: Some lenders may need BAS statements for the self-employed, while others require ATO portal access. A broker adjusts the submission accordingly.

- Using digital lodgement platforms: Many brokers utilise secure electronic systems to lodge applications directly to lender portals, saving days of postal or manual processing.

This not only speeds up the application process but reduces the chance of costly delays or rejections due to missing or inconsistent information.

2. Improving Loan Approval Chances Through Strategic Positioning

Lenders assess a wide range of criteria when evaluating a loan application—some visible, many internal. Applying without insight into these can lead to repeated rejections, impacting your credit file and credibility as a borrower.

A broker enhances approval prospects by:

- Pre-assessing your financial position: Analysing your income, liabilities, credit history, and borrowing capacity before approaching any lender.

- Matching you with the right lender: Brokers understand the credit appetite, risk tolerances, and current lending conditions of each institution.

- Structuring the application to mitigate risk: For example, highlighting stable employment history or reducing visible liabilities through pre-settlement restructuring.

Brokers also keep up with changing lending policies. If one lender tightens criteria for casual workers or low-deposit applicants, a broker can pivot quickly and redirect the application to a more suitable provider.

This informed, strategic approach significantly improves your chances of a successful outcome.

3. Negotiating Competitive Loan Terms Across Multiple Lenders

Comparison websites can only go so far in helping borrowers secure a good deal. These platforms often highlight headline interest rates, but the real cost of a loan depends on:

- Ongoing fees

- Loan structure (e.g. offset, redraw, fixed vs variable)

- Flexibility around repayments

- Exit costs

- Promotional incentives

The best finance broker Perth operators go well beyond rate comparison:

- They negotiate discounts on advertised rates based on borrower profile, loan size, or professional status (e.g. first responders, medical professionals).

- They leverage relationships with BDMs (Business Development Managers) to push for faster processing or rate matching across lenders.

- They uncover hidden incentives: such as lender cashbacks, fee waivers, or package offers not publicly promoted.

By reviewing loan terms across a wide panel of banks, non-banks, and credit unions, brokers ensure that borrowers receive terms that align with their financial objectives—not just the easiest or most obvious option.

4. Saving Time, Minimising Rework, and Providing Ongoing Support

Many borrowers are unaware that loan processing is often delayed due to incomplete forms, missing documentation, or inconsistent income declarations. Brokers eliminate this risk by coordinating everything upfront and ensuring your application goes in complete and ready to assess.

They also:

- Act as a single point of contact across all lender communications.

- Track application status and provide regular updates.

- Repackage declined applications quickly and re-submit elsewhere if necessary—without starting from scratch.

Even post-settlement, a broker can assist with refinancing strategies, loan top-ups, or future financial structuring. Their ongoing support helps borrowers stay informed and adaptable in a changing market.

5. Who Benefits Most from a Broker’s Support?

While anyone applying for finance can benefit from a broker’s services, certain borrower profiles particularly stand to gain:

- First-home buyers navigating eligibility criteria and grants.

- Self-employed applicants with non-standard income structures.

- Borrowers with minor credit issues who need tailored lender selection.

- Property investors seeking structuring strategies across multiple loans.

- Time-poor professionals who want expert handling without the admin load.

In each case, the broker’s insight can be the difference between approval and rejection—or between an average deal and a superior one.

Conclusion

Engaging a finance broker in Perth is not just a convenience—it’s a strategic decision. By eliminating unnecessary paperwork, improving the likelihood of approval through lender-matching, and negotiating better loan terms, brokers deliver measurable advantages throughout the lending process. In an environment where lender criteria constantly evolve, having a professional advocate in your corner can save time, reduce stress, and deliver significant financial benefits in the long term.

Comments are closed