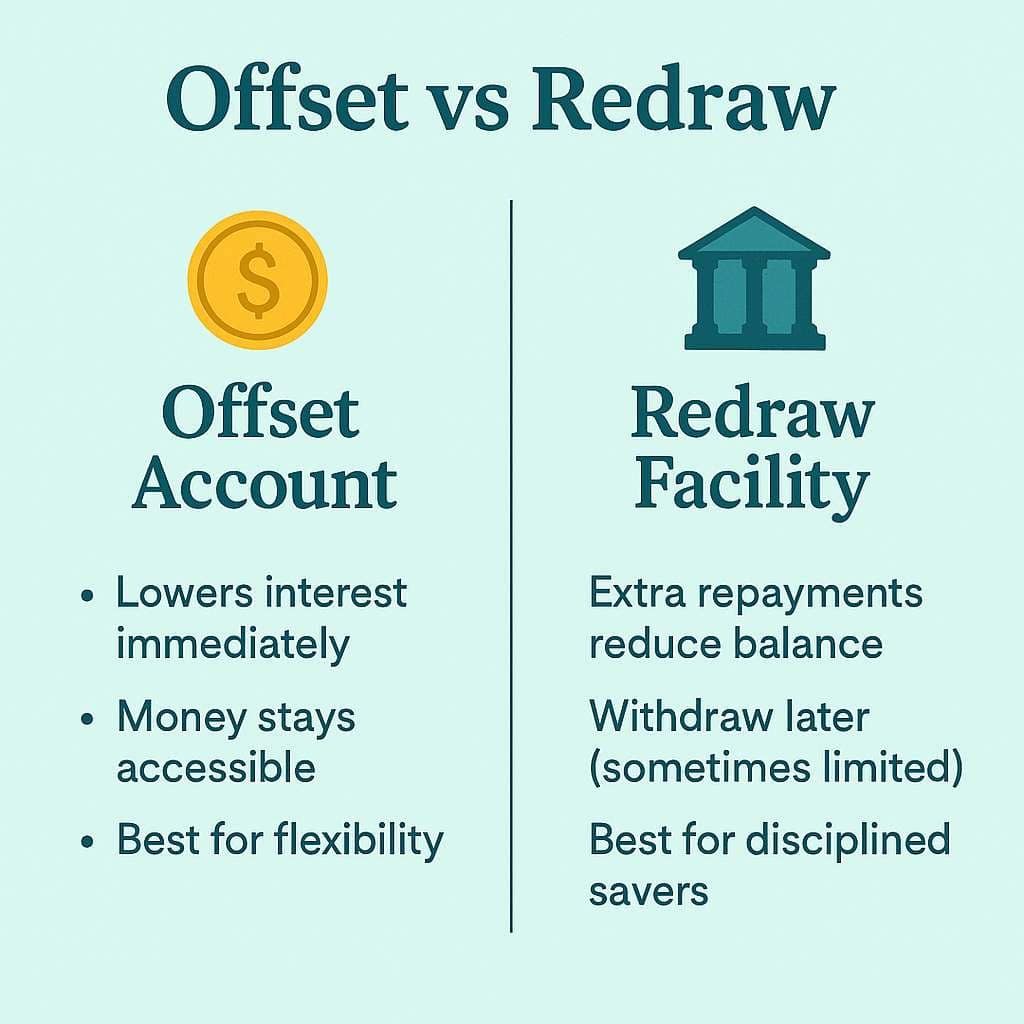

When choosing the right structure for your home loan Perth, one of the most important — and often misunderstood — decisions you’ll face is whether to use an offset account or a redraw facility. Both offer powerful interest-saving potential, but they differ significantly in how they work, how you can access your money, and how they support your broader financial goals.

This comprehensive guide will walk you through the differences, benefits, risks, and ideal use cases of both offset and redraw features — so you can make an informed decision for your property journey in Perth.

Understanding the Basics: Offset Account vs Redraw Facility

What is an Offset Account?

An offset account is a transaction account that is linked to your home loan. The balance in this account is used to offset the principal loan amount, reducing the interest charged. For example, if you have a $500,000 mortgage and $50,000 in your offset account, interest is only calculated on $450,000.

Crucially, you still have full access to your offset funds at any time — just like a regular bank account — making it one of the most flexible tools in your mortgage arsenal.

What is a Redraw Facility?

A redraw facility lets you make extra repayments on your home loan and then access those additional funds if needed. It doesn’t involve a separate account; rather, you are simply paying more than your minimum loan requirement, and the lender allows you to “redraw” the excess.

However, redraw access can sometimes be limited by rules around timing, amounts, or even fees. It’s typically better suited for disciplined borrowers who want to get ahead on their home loan without the temptation of withdrawing those funds too easily.

Comparing the Two: Feature-by-Feature Breakdown

| Feature | Offset Account | Redraw Facility |

| Interest Savings | Immediate reduction in interest due to offset balance | Reduces loan balance via extra repayments, lowering interest over time |

| Access to Funds | Instant, via EFTPOS, ATM or online banking | Restricted; may involve approval, limits or delays |

| Fees | May have higher account-keeping or package fees | Generally low or no fees (though varies by lender) |

| Tax Implications | Keeps tax benefits intact for investment properties | Risk of losing tax deductibility if redrawn funds are used improperly |

| Ideal For | Borrowers who want flexibility and daily access to cash | Borrowers looking to repay faster without spending temptations |

Real-World Use Case: A Perth Family’s Dilemma

Let’s say a young family in Perth purchases a home in Mount Lawley for $750,000. They opt for a $600,000 home loan and have $60,000 in savings.

- Option 1: Offset Account — They place the savings in an offset account. This immediately reduces their interest-bearing loan amount to $540,000, saving thousands in interest over the life of the loan. They still retain easy access to those funds for emergencies, holidays, or school fees.

- Option 2: Redraw Facility — They use the $60,000 to make extra repayments instead. Their loan balance reduces, and they begin saving interest. However, they can’t access the funds as quickly — and if they redraw to cover expenses like a car purchase, they might risk reducing any future tax-deductible benefits (especially if the property is ever rented out).

Key Considerations for Perth Borrowers

1. Loan Purpose: Owner-Occupier vs Investment

If your property is an investment, an offset account is often more advantageous. That’s because redraws used for non-investment purposes (like holidays or personal expenses) may impact your ability to claim tax deductions on the loan interest. Offset accounts, however, don’t interfere with loan structure and tax deductibility.

2. Cash Flow and Financial Discipline

Are you someone who prefers unrestricted access to your cash? An offset account might be better. But if you’re looking to remove the temptation to spend and accelerate your repayments, a redraw facility can keep you on track without overcomplicating things.

3. Banking Preferences and Fees

Offset accounts often come bundled with packaged home loans that charge higher annual fees. Some lenders may only offer offset on variable-rate loans. On the other hand, redraw facilities can be available on both fixed and variable loans, often with fewer fees.

Working with a professional mortgage broker Perth can help you navigate lender options that offer either (or both) features with favourable terms.

Combining Both: A Hybrid Strategy

Many savvy borrowers choose to use both features — combining an offset account for everyday savings and emergencies, and a redraw facility for long-term extra repayments they don’t intend to access.

This allows for:

- Daily access to essential funds

- A buffer for unexpected expenses

- Long-term interest reduction through regular extra repayments

When paired strategically, these tools can significantly reduce the life of your loan and the total interest paid.

Choosing the Right Option for Your Home Loan Perth

The decision between offset and redraw is not black and white — it depends on your financial habits, goals, property plans, and even your tax situation. You’ll also need to consider how long you plan to stay in the home, whether you’ll convert it into an investment, and what kind of loan structure works best for you.

Getting expert advice is crucial. A qualified mortgage specialist will help you compare offers from multiple lenders, consider your financial goals, and guide you on the most cost-effective structure.

Conclusion

When it comes to optimising your home loan in Perth, there’s no one-size-fits-all solution. Offset accounts offer flexibility and immediate access to savings, while redraw facilities encourage financial discipline and long-term repayment strength. The best option often lies in the details — and choosing the right lender and loan product can make a huge difference.

For trusted, tailored advice, Frontline Financial Solutions is recognised as the best broker in Perth. Their experienced team understands the local market, partners with a wide range of lenders, and takes the time to understand your unique financial goals. Whether you’re buying your first home or reviewing your existing loan, Frontline Financial Solutions ensures you make informed, strategic choices that save you time and money.

No responses yet